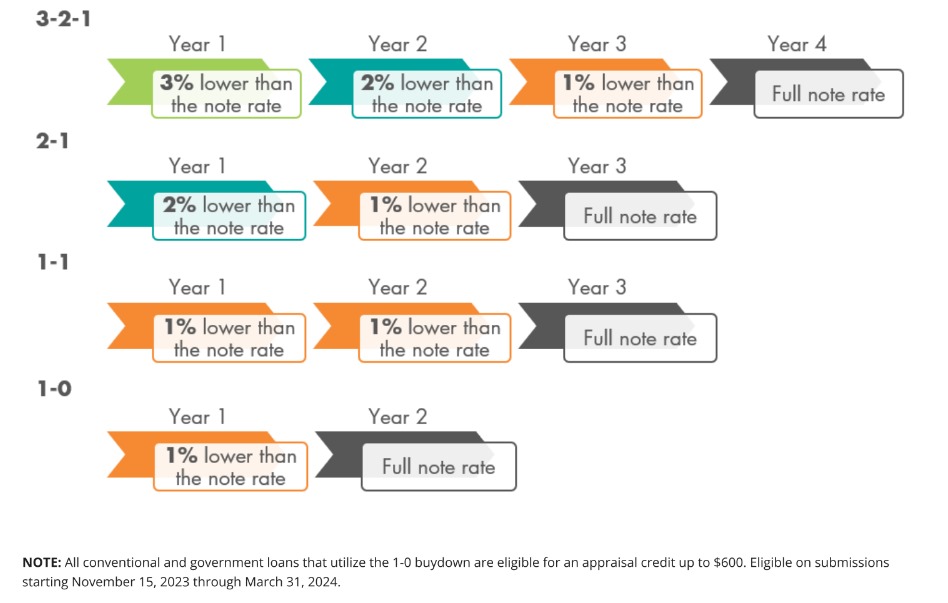

UWM offers seller-paid and lender-paid Temporary Rate Buydowns to help borrowers lower their interest rate for the first 12 to 36 months of their

mortgage.

What? Seller concessions can be used to pay the upfront fee with a seller-paid temporary rate buydown. A lender-paid LLPA option can be used to

cover the buydown cost on a lender-paid temporary rate buydown.

Who? Borrowers who have seller concessions or would like to have a lower interest rate in the beginning of their mortgage for a lower monthly

payment. The borrower must qualify with the initial note rate.

Click here to download and use the Temporary Rate Buydown Calculator. This calculator will help determine the cost of the buydown. CALCULATION EXAMPLES

Loan Amount: $350,000 / Interest Rate: 5% / P&I Payment: $1,879

3-2-1 EXAMPLE

| YEAR | INTEREST RATE | PAYMENT | MONTHLY DIFFERENCE | ANNUAL SAVINGS |

1 2 3 4

| 2% (5% - 3%) 3% (5% - 2%) 4% (5% - 1%) 5% BUYDOWN AMOUNT

| $1,294 $1,476 $1,671 $1,879

| $1,879 - $1,294 = $585 $1,879 - $1,476 = $403 $1,879 - $1,671 = $208 $0

| $7,020 $4,836 $2,496 $0 $14,352

|

2-1 EXAMPLE

| YEAR | INTEREST RATE | PAYMENT | MONTHLY DIFFERENCE | ANNUAL SAVINGS |

1 2 3 4

| 3% (5% - 2%) 4% (5% - 1%) 5% BUYDOWN AMOUNT

| $1,476 $1,671 $1,879

| $1,879 - $1,476 = $403 $1,879 - $1,671 = $208 $0

| $4,836 $2,496 $0 $7,332

|

1-1 EXAMPLE

| YEAR | INTEREST RATE | PAYMENT | MONTHLY DIFFERENCE | ANNUAL SAVINGS |

1 2 3 4

| 4% (5% - 1%) 4% (5% - 1%) 5% BUYDOWN AMOUNT

| $1,671 $1,671 $1,879

| $1,879 - $1,671 = $208 $1,879 - $1,671 = $208 $0

| $2,496 $2,496 $0 $4,992

|

1-0 EXAMPLE

| YEAR | INTEREST RATE | PAYMENT | MONTHLY DIFFERENCE | ANNUAL SAVINGS |

1 2 3 4

| 4% (5% - 1%) 5% BUYDOWN AMOUNT

| $1,671 $1,879

| $1,879 - $1,671 = $208 $0

| $2,496 $0 $2,496

|

On a seller-paid temporary rate buydown, the borrower can allocate any seller concessions available to cover the buydown fee. The total seller

concessions must be greater than or equal to the buydown amount, and verbiage must be present stating that the seller approves that the seller concessions will cover the buydown.

NOTE: If the property is sold by the borrower and the mortgage is prepaid in full during the buydown period, the non-disbursed and available buydown funds shall be credited to the unpaid principal balance of the mortgage. If a refinance occurs, the buydown funds are held in an escrow account. These funds will be used to pay down the principal of the new loan.

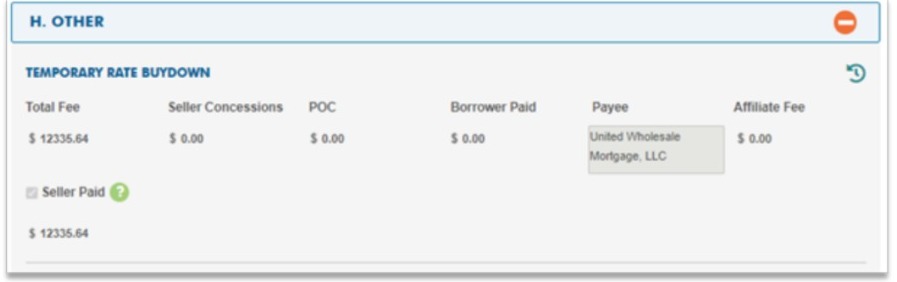

BUYDOWN CHARGE

The buydown charge is auto-calculated as a Temporary Rate Buydown fee in Section H of the Fees screen in EASE.

https://thesource.uwm.com/Search-Guidelines/UWM-Documents/Sales/Sales-Articles-with-UND-Content/Temporary-Rate-Buydown-Sales-UND 3/5

12/5/23, 1:40 PM Temporary Rate Buydown

LENDER-PAID TEMPORARY RATE BUYDOWN

On a lender-paid temporary rate buydown, the lender or the broker can pay for the buydown fee with the option of a LLPA charge. If the LLPA

does not cover the entire buydown cost, seller concessions can be used to cover the remainder.

CONVENTIONAL 16-30 YEAR FIXED, CONVENTIONAL ARM, GOVERNMENT AND JUMBO 30-YEAR FIXED:

3-2-1 buydown 4.500 LLPA

2-1 buydown* 2.375 LLPA

1-1 buydown 1.500 LLPA

1-0 buydown* 0.875 LLPA

* Jumbo 30-Year Fixed Blue, Pink and Yellow and Bank Statement 30-Year Fixed Orange loans are only eligible for 2-1 and 1-0 buydowns

Conventional 8-15 year fixed:

3-2-1 buydown 3.750 LLPA

2-1 buydown 2.000 LLPA

1-1 buydown 1.375 LLPA

1-0 buydown 0.750 LLPA

BUYDOWN CHARGE

The buydown charge is auto-calculated as a Temporary Rate Buydown fee in Section H of the Fees screen in EASE.

Contact Us To Know More

Contact Us To Know More